Club achieve success in reversing motorhome tax increase

15/05/2020

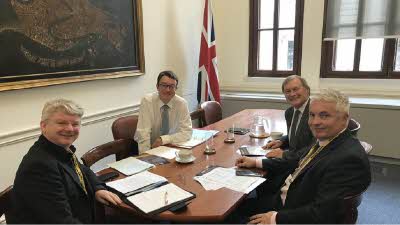

The Club's technical manager Martin Spencer (far left) met with Treasury minister Simon Clarke MP, campaign supporter Sir Davis Amess MP and NCC director general John Lally

The Club's technical manager Martin Spencer (far left) met with Treasury minister Simon Clarke MP, campaign supporter Sir Davis Amess MP and NCC director general John Lally

The Caravan and Motorhome Club has successfully helped persuade the Government to reverse some of its changes to Vehicle Excise Duty.

Representatives from the Club joined other members of the touring industry to lobby the Government and HM Treasury in regards to the changes which made taxing a motorhome much more expensive.

While the Club didn’t get everything it was campaigning for, the key change – reversing the decision to tax motorhomes as if they are cars – was made.

Here are some further details...

- From 1 September 2019 to 12 March 2020, the majority of motorhomes were placed in passenger car VED classes. This meant owners paid a very high rate of tax in their first year (typically £2,135), a lower amount in years two to six (£465) and a much lower amount in subsequent years (£145). The rate in years two to six includes £320pa premium tax for vehicles that cost more than £40,000 (as is the case for most new motorhomes).

- The budget on 11 March 2020 changed things back to the situation preceding 1 September 2019 – ie from 12 March, the majority of motorhomes will be taxed along with vans and other commercial vehicles in the Private/Light Goods or Private/Heavy Goods categories (the latter if weighing over 3,500kg). That means most motorhome owners will pay £265pa (or £165pa if their vehicle is over 3,500kg).

- For the unfortunate group of owners whose vehicles were registered from 1 September 2019 to 11 March 2020, HM Treasury has informed us that there is no way to retrospectively amend their taxation. Those vehicles continue to be taxed at the rates that applied when they were sold. This is an issue that subsequent owners will need to note too – during their first six years, these vehicles will be more expensive to tax; after that, they will be slightly less costly.

- The new tax rates apply until the end of March 2021. From 1 April 2021, motorhomes will remain aligned with light goods vehicle taxes, but there will be a new regime for those payments. Full details, including rates at which goods vehicles and motorhomes will be taxed, have not yet been determined. We expect to see details of those rates near the end of 2020.

The change came after a very well-run campaign led by the industry’s trade body, the National Caravan Council (NCC), which gained support from a large number of MPs. The Club was closely involved, supporting the campaign on behalf of members, contacting parliamentarians and attending a meeting at the Treasury, where we were able to present concerns directly to the key decision maker on this issue. We also spoke directly with the Head of Vehicle Taxation, the senior civil servant responsible for implementing tax policy.